Over the past few days, the cryptocurrency market has witnessed significant movements, driven mainly by the surge in Bitcoin and intense activity on the Solana network. Key events, including record inflows into the iShares Bitcoin TrustETF (IBIT) and the effect of the US presidential election, have helped transform the cryptocurrency and blockchain financial landscape, showing both institutional and private investor interest in high-yield products.

This past week, iShares Bitcoin Trust reached a historic milestone with daily inflows of $1.12 billion, surpassing the previous high of $872 million recorded just a week earlier. This interest pushed IBIT’s total assets under management to $33.91 billion. At the same time, the price of Bitcoin touched new highs, approaching the $90,000 mark in the last 24 hours. This trend is clear evidence of growing institutional interest, with companies and asset funds seeing Bitcoin as a stable and regulated opportunity to diversify their investments.

It is no coincidence that institutional capital inflows into Bitcoin surpassed the initial inflows into gold ETFs, reaching $20 billion in the first year. This comparison between Bitcoin and gold suggests a strong appetite for cryptocurrencies, perceived as an alternative value asset. The market’s positive reaction to the US elections, which also saw the Nasdaq and the S&P 500 reach new highs, has further strengthened interest in cryptocurrencies.

But there are not only the ‘longs’, we also see the ‘shorts’: the market also saw a huge wave of liquidations of short positions on Bitcoin, with a total value of $427 million liquidated on major exchanges such as Binance and Bybit. This was the largest liquidation of short positions in a single day since May 2024, surpassing the August record of $266 million. This phenomenon was followed by a remarkable recovery in the price of Bitcoin, which soared after the election.

Open interest on Bitcoin futures increased from $31.64 billion to $36.86 billion. This indicates that investors remain confident in Bitcoin’s prospects, despite market fluctuations. The high open interest is a sign of the sector’s growth, with more investors entering the market and reinforcing confidence in the role of derivatives in setting Bitcoin prices.

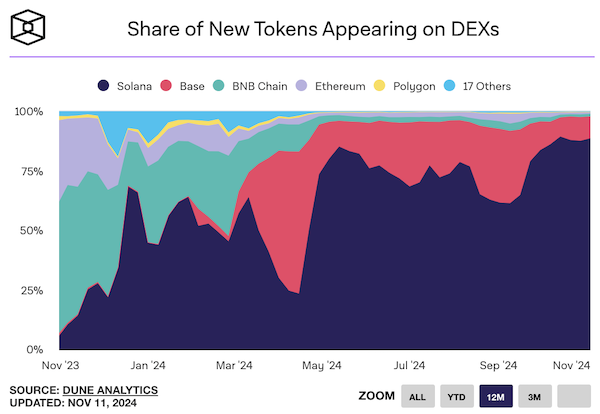

Not just Bitcoin, there are also altcoins. Solana, in fact, continues to stand out as the preferred network for launching new tokens. Some 89% of the new tokens launched in the last week were built on Solana, demonstrating the growing involvement of users. During this period, the network handled around 41 million transactions, a large proportion of which were memecoins. Solana has emerged as a popular platform due to its low fees and fast transaction times, ideal features for handling high volumes of activity without prohibitive costs.

Despite the large number of new tokens launched, only 1% manage to obtain a stable listing on platforms such as Raydium. However, the ability to create and distribute new tokens quickly has attracted many investors interested in high-risk, high-return opportunities. The growth of the memecoin ecosystem reflects the interest in speculative investments. But this memecoin inflation and instability, which has and is burning the wallets of many investors, has stabilised the historic DOGEs and SHIBs more. On the latter then there is a direct and indirect relationship with Elon Musk, who after the US elections has even more bought power and market positioning.